乐动网页版-乐动(中国),乐动(中国)

品质保障 超值创造

2020-03-12

SIXN苏州时兴 | 爱心成就梦想

2022-12-09

SIXN 苏州时兴 | 树新风、立新貌,持续推进5S管理

2023-11-17

联系我们

如有任何问题,请给我们留言或拨打联系电话 +86-512-82872166-8019

客户留言

描述:

联系我们

CONTACT US

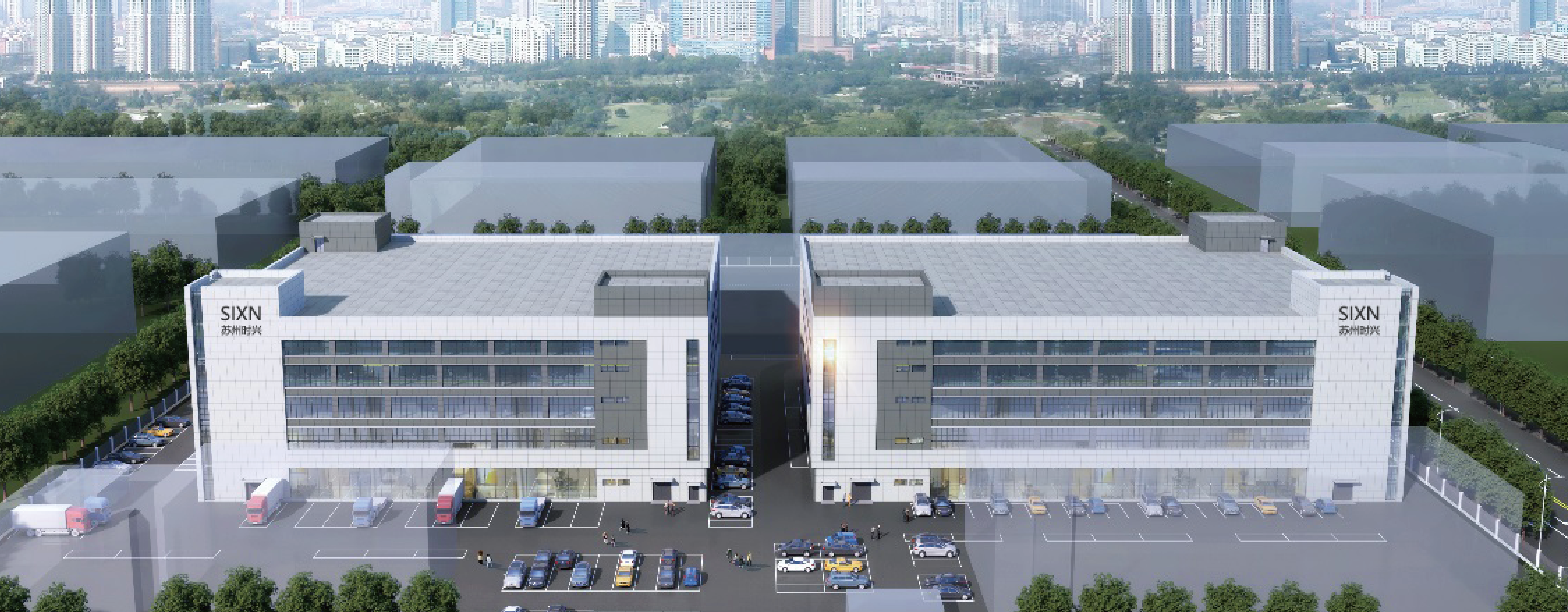

地址:江苏省苏州市吴江区盛泽镇园区路3285号

版权所有:乐动网页版-乐动(中国),乐动(中国) | Copyright - 2021 All Rights Reserved. 苏ICP备17000460号-1 技术支持: 中企动力 昆山

关注微信公众号

查看手机官网